The financial ecosystem demands precision, security, and rapid decision-making. Sukra’s Agentic AI solutions empower banks, NBFCs, insurers, wealth managers, and fintech platforms to operate with greater accuracy, faster insights, and lower operational overhead. By combining advanced AI agents, automated document intelligence, secure transaction frameworks, and predictive analytics, we help financial institutions transform into agile, insight-driven organizations.

Key Capabilities

These AI agents reduce manual compliance workload and improve investigation turnaround time.

Financial workflows involve heavy dependence on PDFs, statements, forms, and reports. Sukra’s Document AI eliminates manual extraction and verification.

What We Automate

This ensures faster onboarding, accurate data capture, and audit-ready compliance.

Sukra builds intelligent dashboards that merge financial data, market indicators, and client profiles to support advisors and investors.

Capabilities

These tools empower wealth managers with real-time portfolio intelligence and decision support.

Using ML & Agentic AI, financial institutions gain deeper foresight into market movements and customer behavior.

Our Predictive Models

Outcome: Better loan decisions, reduced NPAs, and improved portfolio health.

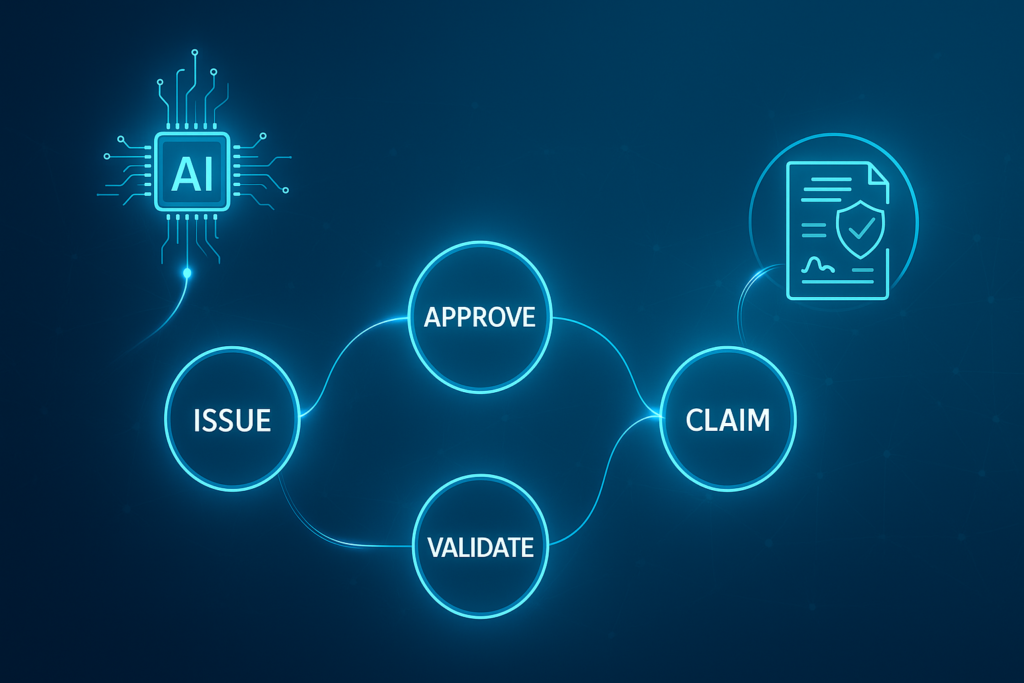

We modernize insurance operations with AI-enhanced processing.

Solutions Offered

This results in faster claim resolution, improved customer satisfaction, and reduced operational effort.

Financial transactions require failproof security. Sukra integrates secure, audit-grade systems to protect all payment workflows.

Capabilities

Ensures trust, transparency, and end-to-end transaction traceability.

Operational Efficiency

Risk Reduction

Growth Acceleration

Sukra delivers secure, production-ready AI and digital platforms designed for the stringent demands of financial institutions, deployed seamlessly across cloud and enterprise environments. Our solutions help banks and financial organizations reduce risk, improve compliance, and accelerate decision-making through intelligent automation and data-driven insights. By modernizing legacy workflows with scalable AI, analytics, and digital systems, Sukra enables faster operations, lower costs, and enhanced customer trust.

Where innovation meets execution — Sukra Infotek transforms bold ideas into intelligent realities!

Don’t miss our future updates! Get Subscribed Today!